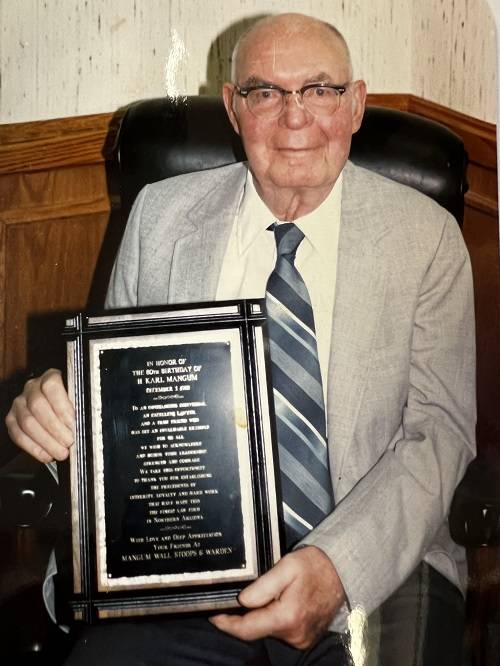

Flagstaff Trusts Attorneys Help Clients Achieve their Goals

Arizona firm offers guidance on asset management and distribution

If you’re looking for help with setting money aside for a loved one or a charity once you’re gone, a Flagstaff trusts attorney at Mangum, Wall, Stoops & Warden, P.L.L.C. can explain how a revocable or irrevocable trust can help you achieve the result you seek. Our experienced Arizona lawyers develop and administer these legal instruments to help families avoid the probate process, endow a charitable cause and for other purposes.

What is a trust and why would you need one?

While a will states how a decedent’s property will be distributed, trusts are more flexible and can serve many purposes while the trust creator is still alive. Even if you choose to transfer your assets upon your death through a trust for tax purposes or another reason, you should also have a will to avoid state intestacy laws in case some property remains outside the trust. Our Flagstaff estate planning attorneys can build a comprehensive plan so that your will and trust(s) complement each other.

Benefits of revocable and irrevocable trusts

Revocable trusts can be altered or eliminated completely. Living trusts are revocable instruments that allow someone lifelong access to the assets they placed into the trust. Upon their death, what remains in the living trust is transferred to designated beneficiaries who do not have to wait through the probate process to use the funds. Irrevocable trusts, on the other hand, don’t offer the same flexibility but might confer tax benefits on the trust creator, who no longer retains legal control of the property that has been shifted into the trust.

Flagstaff estate planning attorney creates specialty trusts

Our firm helps clients establish various types of trusts exist, including:

- Special needs trusts — If you have a son or daughter with special needs and are concerned about their financial support after you are gone, you can appoint a trustee to distribute assets that you designate for their benefit.

- Generation skipping trusts — High net worth individuals sometimes opt to create generation skipping trusts that avoid estate taxes by directing funds to the grantor’s grandchildren.

- Dynasty trusts — Families with enough assets to exceed the estate tax exemption might wish to establish a dynasty trust that reduces a family’s overall financial burden by eliminating subsequent taxable events.

- Education trusts — Parents and other loved ones create education trusts so they can be sure that the money they provide will go toward a young person’s schooling.

- Pet trusts — Older clients sometimes draft a legal instrument so they know their beloved pet will be well cared for.

- Charitable trusts — Funds that you deposit into a charitable trust can benefit a cause you believe in even after you are gone.

- Life insurance trusts — By making an irrevocable trust the beneficiary of a life insurance policy, you can have more control over the allocation of the proceeds.

One of these trusts might be the right solution to your estate planning concerns. We will give you sound advice on your options and can create an instrument tailored to your needs.

How is a trust established in Arizona?

You decide what assets you want transferred into the trust and set forth instructions as to how those assets will be distributed to beneficiaries. It’s your choice whether you will serve as trustee or appoint someone else. We prepare the necessary documents, including trust terms, deeds and asset lists, so that you can create a legal instrument that accomplishes your goals.

Trust administration

Serving as a trustee is a serious responsibility, and our firm offers skillful assistance with a wide array of trust administration matters, including interpretation of trust language, completion of transactions and termination based on trust terms or because assets have been depleted. When litigation of a trust dispute becomes necessary, we are strong courtroom advocates for trustees and beneficiaries.

Contact a knowledgeable Arizona attorney regarding trust creation or administration

Mangum, Wall, Stoops & Warden, P.L.L.C. in Flagstaff advises Arizona clients on issues relating to trusts. For a consultation, please call 928-779-6951 or contact us online.